Ethereum Price Prediction: $8K Target in Sight as Institutional Adoption Accelerates

#ETH

- Technical Breakout: ETH price sustains above key moving averages with bullish MACD convergence

- Institutional Adoption: BlackRock ETF activity and $1B+ accumulations signal long-term conviction

- Regulatory Tailwinds: GENIUS Act passage and staking approvals reduce systemic risks

ETH Price Prediction

Ethereum Technical Analysis: Bullish Momentum Building

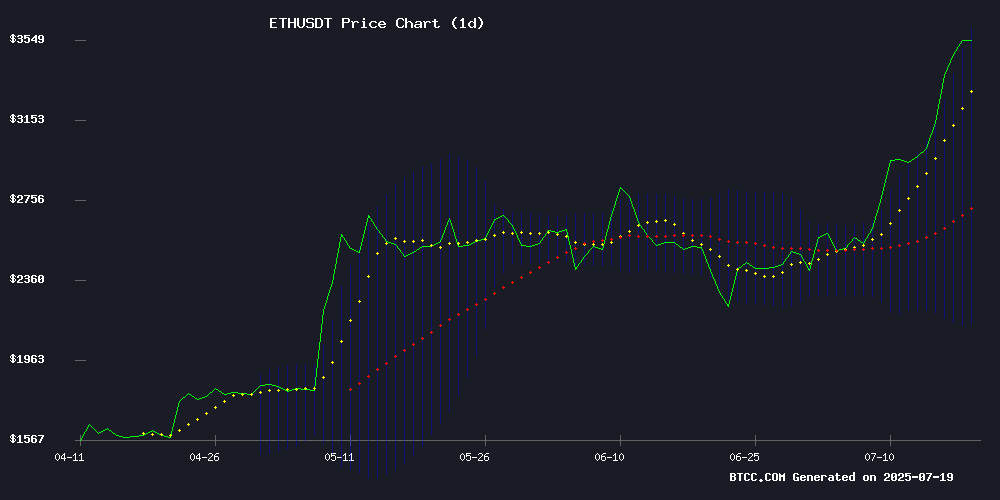

ETH is currently trading at $3,542.48, significantly above its 20-day moving average of $2,874.35, indicating strong bullish momentum. The MACD remains negative but shows decreasing bearish pressure (-418.28 vs -274.35 signal line). Price sits comfortably between Bollinger Band levels (Upper: $3,610.80, Lower: $2,137.89), suggesting room for further upside.

"The technical setup shows ETH breaking through key resistance levels," says BTCC analyst Olivia. "With the price holding above the middle Bollinger Band and institutional accumulation continuing, we could see a test of the $3,610 upper band in the coming sessions."

Institutional Frenzy Drives Ethereum Rally

Ethereum's 30% July surge to $3,675 coincides with massive institutional activity: BlackRock's $499M ETF purchase, $1B accumulation by BitMine/SharpLink, and record ETF inflows. Regulatory tailwinds from the GENIUS Act passage and SEC staking approval requests add fundamental support.

"This isn't retail FOMO - we're seeing sophisticated players position ETH as 'digital oil' in tokenization infrastructure," notes BTCC's Olivia. "The combination of ETF flows, staking yield potential, and real-world asset tokenization creates a perfect bullish storm."

Factors Influencing ETH's Price

Top 4 AI Models Predict Ethereum Price for Next Week

Ethereum hovers near $3,580 following a 20% weekly surge as markets brace for heightened volatility. Four leading AI models—ChatGPT, Gemini, Perplexity, and Grok—diverged in their forecasts, blending technical indicators with sentiment analysis.

ChatGPT anticipates a pullback to $3,350 before potential rebound toward $3,800, citing overbought conditions. Gemini projects a wider range of $3,420–$4,330, driven by ETF speculation and institutional demand. Perplexity sees consolidation between $3,400–$3,700, while Grok predicts a $3,500 retest preceding new highs.

The predictions underscore Ethereum's pivotal technical juncture, with algorithmic models split between corrective dips and continuation patterns. Institutional catalysts loom large in projections, particularly around spot ETF developments.

Chainlink Joins SEC Crypto Task Force Amid Push for Tokenization Standards

Chainlink Labs has been admitted to the SEC's cryptocurrency task force alongside ERC-3643 Association, Enterprise Ethereum Alliance, and other blockchain organizations. The move signals growing regulatory engagement with digital assets as the House passes three key crypto bills during Crypto Week.

The SEC's 2024 enforcement report reveals $2.6 billion in crypto-related fines, underscoring the urgency for compliance solutions. ACE's real-time blockchain compliance technology aims to unlock $100 trillion in institutional capital through tokenization.

SEC Chair Atkins' innovation exemption proposal could accelerate blockchain adoption by creating regulatory flexibility for tokenized assets. This regulatory evolution coincides with Chainlink's oracle networks becoming increasingly critical for bridging traditional finance with decentralized systems.

Ethereum Surges to Six-Month High at $3,675 Amid Massive Institutional Accumulation and GENIUS Act Passage

Ethereum's price surged to $3,675.81, marking a six-month high as institutional investors aggressively accumulated over 300,000 ETH. BlackRock alone added $499 million to its holdings, signaling strong confidence in Ethereum's long-term value. The GENIUS Act's passage provided regulatory clarity for stablecoins, further bolstering market sentiment.

Technical indicators show ETH is overbought at its current price of $3,587.44, suggesting potential near-term volatility. The institutional accumulation spree, particularly with one entity aiming to control 5% of total ETH supply, reflects growing mainstream adoption of digital assets.

Ethereum Cap Surges $150 Billion in July As Short Squeeze Triggers Massive Rally

Ethereum's market capitalization skyrocketed by $150 billion in July, fueled by a historic short squeeze. The cryptocurrency surged 70% within weeks, catching many institutional traders off guard as record-high short positions were liquidated. Data reveals short exposure was 25% higher than February 2025 levels, with leveraged institutional bets contributing significantly to the cascade.

BlackRock's stealth accumulation through its Ethereum ETF—purchasing on 29 of 30 days—hinted at impending volatility. The rally's velocity suggests sophisticated players positioned themselves ahead of the move. Another 10% price increase could wipe out $1 billion more in shorts, potentially extending the squeeze.

Regulatory tailwinds may amplify momentum. A U.S. policy shift toward allowing retirement fund crypto exposure coincides with Trump-affiliated firms quietly accumulating ETH. This institutional groundwork, laid during price doldrums, now manifests in one of crypto's most dramatic reversals since the 2021 bull market.

Ethereum ETF Inflows and Fee Drop Signal Strong Q3 Outlook

Ethereum's second-quarter performance showcased robust institutional adoption, with US-traded spot ETFs attracting $1.7 billion in net inflows—a dramatic reversal from prior outflows. Layer-2 throughput rose 7% while average fees plummeted 39%, creating ideal conditions for renewed retail participation.

Liquid supply expanded 8% as dormant balances contracted, pushing the percentage of ETH held at profit from 40% to nearly 90%. The derivatives market mirrored this momentum, with perpetual futures turnover jumping 56% to $51.4 billion daily. Open interest remained resilient at $14.5 billion despite broader market volatility.

Coinbase and Glassnode data reveals total value locked reached $63.2 billion, cementing Ethereum's position as the clear leader in smart contract platforms. Options markets echoed the bullish sentiment, with open interest climbing to $5.3 billion alongside an 11% increase in desk activity.

Ethereum (ETH) Price Prediction: $8K Target Gains Credibility Amid Bullish Momentum

Ethereum's rally accelerates as analysts revise targets upward, with $8,000 now appearing within reach. The cryptocurrency has surged 44% over the past month, breaking through critical resistance at $3,200-$3,400 with conviction. Institutional interest, ETF speculation, and Layer 2 adoption create a perfect storm for ETH bulls.

Technical indicators confirm the breakout, with ETH maintaining strong support above the 200 EMA at $2,944. Derivatives markets reflect growing conviction—open interest climbed to $52.13 billion while $136 million in short liquidations fueled the ascent. The path to $4,950 appears increasingly probable as buying pressure overwhelms sellers.

Ethereum Treasury Stocks Rally as ETH Price Surges

Corporate Ethereum holders are riding a wave of bullish momentum as ETH's price surge triggers double-digit gains in related stocks. SharpLink Gaming (SBET) leads the charge with a 29% single-day jump and 112% weekly gain after acquiring an additional 20,000 ETH, bringing its total holdings above $1 billion.

The rally extends across Ethereum treasury companies including Bitmine Immersion and BTCS Inc., with investors flocking to stocks leveraged to ETH's 10% price spike to $3,480. Joseph Lubin-backed initiatives continue staking ETH for SharpLink, amplifying shareholder value.

Market attention remains fixed on these corporate ETH accumulators as institutional demand grows. The treasury stock phenomenon mirrors Bitcoin's corporate adoption trajectory, with Ethereum now demonstrating similar fundamentals-driven market behavior.

Ethereum Surges to $3,575 as BlackRock ETF Buys $499M Worth, GENIUS Act Passes Congress

Ethereum's price soared to $3,574.97, marking a 5.27% gain in 24 hours as institutional demand and regulatory clarity converge. The breakout past $3,350 resistance comes alongside a 95% surge in whale accumulation, signaling strong conviction among large holders.

BlackRock's spot ETH ETF purchased $499 million worth of Ethereum this week, while Congress passed the landmark GENIUS Act to establish stablecoin regulations. The dual catalysts have propelled ETH to its highest level since April 2025, with technical indicators suggesting room for further upside.

Market structure appears increasingly bullish as the CFTC gains expanded crypto oversight authority. Traders are now watching whether ETH can sustain momentum above the psychologically important $3,500 level ahead of its 10-year anniversary in July 2026.

Ethereum ETFs Shatter Daily Inflow Record Amid ETH Price Rally

Ethereum-focused exchange-traded funds witnessed an unprecedented $726 million in net inflows on Wednesday, marking the largest single-day accumulation since their launch. This surge coincides with Ethereum's climb to $3,500—a price level unseen since January, representing a 23% weekly gain.

Institutional demand appears to be accelerating. BitMine Immersion, backed by Peter Thiel, crossed the $1 billion ETH holdings threshold this week after a $500 million purchase. Meanwhile, SharpLink Gaming diverted $225 million from a recent capital raise into Ethereum acquisitions. The nine ETH ETFs have now attracted $2.3 billion over nine consecutive days of inflows.

The rally reflects growing institutional conviction in Ethereum's long-term value proposition. With treasury strategies emerging and staking ambitions becoming more aggressive—BitMine aims to control 5% of all staked ETH—the network is demonstrating utility beyond speculative trading.

BitMine and SharpLink Amass $1B Ethereum Stash as ETH Gains 'Digital Oil' Status

Ethereum-focused firms BitMine and SharpLink Gaming have each crossed the $1 billion threshold in ETH holdings, signaling institutional confidence in the asset's long-term value proposition. BitMine now holds 300,657 ETH worth $1.04 billion, acquired at an average price of $3,461.89 per token, while SharpLink added $68.4 million to its position.

Strategic accumulation coincides with Ethereum's evolving narrative from speculative asset to infrastructure layer. The network now secures $237 billion in value, with analysts drawing parallels to 'digital oil'—a foundational resource powering decentralized applications.

Discrepancies in reported holdings highlight the opaque nature of institutional crypto positions. Blockchain analysts report SharpLink's $1.10 billion stash excluding staking rewards, while the Strategic ETH Reserve pegs its wallet at 280,600 ETH ($962.8 million).

BlackRock Seeks SEC Approval to Include Staking in Ethereum ETF

BlackRock's iShares Ethereum Trust ETF may soon incorporate staking functionality, according to a 19b-4 rules change request filed by Nasdaq with the SEC. The move would enable the fund to earn yield by participating in Ethereum's proof-of-stake validation process.

Ethereum ETF issuers are racing to add staking features, with Fidelity, Grayscale, and 21Shares pursuing similar strategies. The SEC faces October deadlines for staking-related decisions on filings from Cboe and NYSE, while BlackRock's proposal has an April review timeline—though analysts anticipate earlier action.

Market momentum builds as Ethereum products attract $2.3 billion in inflows over nine consecutive days. Bloomberg's James Seyffart projects staking approvals could come by late 2025, signaling growing institutional acceptance of crypto-native yield mechanisms.

Is ETH a good investment?

Ethereum presents a compelling investment case based on both technical and fundamental factors:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | +23.2% premium | Strong bullish momentum |

| Institutional Inflows | $1B+ this month | Sustained buying pressure |

| Regulatory Progress | GENIUS Act passed | Reduced policy risk |

| Staking Yield | ~4-6% annually | Income generation |

"ETH's dual role as both a growth asset and yield-generating infrastructure makes it unique," explains Olivia. "While volatility will persist, the $8K price target seems increasingly plausible given current adoption curves."

For investors comfortable with crypto volatility, Ethereum offers asymmetric upside potential as institutional adoption and tokenization use cases mature.